Content

- Clever Girl Finance: Learn How Investing Works, Grow Your Money, by Bola Sukunbi

- Best for Visual Learners: Napkin Finance: Build Your Wealth in 30 Seconds or Less

- “YOU CAN BE A STOCK MARKET GENIUS” by Joel Greenblatt

- One Up On Wall Street

- #10 “The Little Book that Beats the Market”

- #4. Common Stocks and Uncommon Profits and Other Writings

Old books on trading will help you see the fundamentals – the big picture, to help you contextualise the technical information you might find on the internet and in more current books. Bubbles and market cycles are important to understand, and a well-formulated investment strategy can help you avoid the biggest pitfalls of the boom and bust cycle. Shiller argues that psychologically driven volatility is a risk in all asset markets, including the stock market. Philip Fisher, one of the most influential investors of all time, authored this 1958 take on investing. Fundamental concepts in the book include technical and fundamental analysis, whether or not actively managed mutual funds make sense, and other tried and true investment theories.

Investors hold the book with such high regard that many still refer to it for help even after all these years. The book is written with special attention to using as simple a language and even the technical terms are presented in a plain manner so that it could be understood by the novices. The book features interviews between the author and some of his clients he helped to greater investment glory. The lessons here track the company from $18 per share in 1965 to $297,600 per share as of the 2017 letter. If you can invest like Buffett, you should be on track to great investment success. The offers that appear on this site are from companies that compensate us.

The book follows the life of speculator Jesse Livermore, from his humble beginnings as a teenager on the trading floor to his eventual rise to fortune and subsequent fall from grace. It is as much a cautionary tale as a celebration, showing the risks and rewards inherent in the turbulent world of stock speculation. Thompson-esque in its vivid detail and unvarnished truth, Reminiscences of a Stock Operator is a must-read for any investor, novice or otherwise. It is an unflinching account of the highs and lows that come with speculating, and a powerful reminder of the importance of risk management in any investment strategy. This stock market trading guide features tips on identifying the best stocks, building mutual funds, and earning ETFs to maximize your stock gains. Since its launch, the book has influenced generations of investors through various lessons found in this book.

In this thorough yet relatively short book, Bach offers tips on how to ensure that you live well and not stress out about money and end up with a secure financial future. In “The Single Biggest Investment Mistake You Can Make,” Bach writes that it is when employees fail to invest in retirement accounts. That’s especially true, he adds, in the case of company-sponsored 401(k) plans in which the employer offers a match—which, in effect, gives the worker free money. It doesn’t matter if you’re fresh out of college or a teenager who has realized how significant investing can be. These picks of the best books for young investors will help you succeed. While there’s a lot to decide about starting in your 20s and 30s, if you are disciplined enough to break through the noise, now is the optimal time to start learning about investing.

With a focus on broad coverage of various topics, we’ve compiled a list of 15 informative and highly recommended books to help you navigate this exciting and potentially lucrative arena. If you look at the example of the Indian stock market, this book along with the Indian stock markets teaches how you should listen to an investment in which risk is low and profit is very high. This book is one of the best books published on stock market investing and the all-time best seller. This book can prove to be an important book for the early investors of the stock market. Though the market has changed quite a bit, the principles of smart trading have stayed the same. In fact, many of today’s prominent investors have been influenced to think in line with the theories found in these books, thereby affecting the market with their purchases.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards best books for stock market beginners in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. Our editorial team does not receive direct compensation from our advertisers.

Peter Lynch explains how Wall Street may not be able to find the best investing opportunities from the start and shows step-by-step how the individual investor can find the next winner. Whether you’re the former or the latter, each of the following books will provide you with investing lessons from some of the world’s brightest financial minds. Today, there are revised editions of this book containing contributions from Buffett and other financial experts.

Clever Girl Finance: Learn How Investing Works, Grow Your Money, by Bola Sukunbi

Once you’ve got the basics down, the book focuses on how to research investments and where to make purchases once you’re ready. It’s a great choice for recent graduates and those early in their careers. If you are truly just starting out in your investing journey, this book is a great place to start. You’ll learn tips on how to save and invest for your future and get excellent advice on what to avoid in the financial world.

Hopefully, I’ve convinced you how important it is to read and learn, especially if you are new to investing. Luckily, I’ve compiled a list just for you (don’t worry, you won’t have to translate anything from Spanish). She writes about dry topics in an engaging style, and she makes complicated jargon relatively easy to understand. Currently, to read the price movement, most technical analysts follow Japanese candlestick chart patterns, so accordingly this book becomes very important.

Best for Visual Learners: Napkin Finance: Build Your Wealth in 30 Seconds or Less

Any of the books on our list can help you learn day trading, but on their own, they probably won’t give you the in-depth understanding you would need to make a profit from this risky strategy. You may decide to take a course with added features such as chatrooms, stock simulators, and mentors, or consider a different trading style. “Mastering the Market Cycle” is a 340-page book by renowned investor and author Howard Marks.

For example, you may decide to invest $100 in a stock every month, regardless of the stock price. Some months the stock will be more expensive and you’ll get fewer shares, and other months it will be less expensive and you’ll end up with more. This is less risky than trying to maximize on trends that occur in one day, as with day trading. Unlike „How to Day Trade for a Living,” though, this one is for people who already have experience day trading and want to take things to the next level. Starting with the most well-known and essential titles for complete novices, we’ll also introduce you to some less commonly known but highly informative options to broaden your knowledge base. If you’re seeking an even larger selection, be sure to check out our companion guide featuring over 25 additional books on investing.

- I hope you have realized that if a person does not get booked, then how many things he will miss in his life and he will learn all the mistakes by himself and by this he spent a lot of time by mistake and then learning by mistake.

- Whether you adopt the formula yourself or not, the book is one of the best at showing how and why a simple strategy can generate outstanding returns over time.

- In it, Marks explores the cyclical nature of market performance and discusses the strategies necessary to navigate the inevitable downturns and come out ahead.

- The Essays of Warren Buffett is a collection of Buffett’s letters to Berkshire Hathaway’s shareholders, written over several decades.

- Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

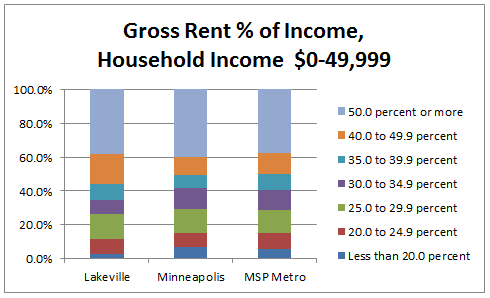

In this book, Brandon Turner lays out how to make money through rental properties, taking you through the whole process of buying your first unit, to collecting those rent payments. If you’ve ever wondered how to make money through real estate, this book is a great place to start. Vanguard Group founder John Bogle, who died in 2019, spent his career advocating for and providing products and services that benefited everyday investors. Legendary investor Warren Buffett wrote in 2017 that if a statue were ever built to honor the person who had done the most for U.S. investors, the choice should be Bogle. Bankrate follows a strict

editorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

“YOU CAN BE A STOCK MARKET GENIUS” by Joel Greenblatt

If you enjoyed reading this article and if you have any questions, then you can write them in the Comment Box. And if you are an engineer, then you should invest in engineering companies. We recommended the book Learn to Earn which was written by Peter Lynch.

He’s famous for buying and holding small-capitalization companies that grew immensely over long periods, such as his 1955 investment in Motorola. Like Buffett, billionaire investor and Margin of Safety author Seth Klarman is a close follower of Benjamin Graham and an advocate of value investing — hence the book’s name. They can also be valuable for people who aren’t interested in a finance career, but perhaps have traded successfully for years as a hobby and want to learn more.

However, without proper knowledge and understanding, it can also lead to costly mistakes. As a beginner, it’s crucial to learn the basics of stock market investing to make informed decisions for your financial future. It is a breathtaking recount of how a young boy managed to amass one of the largest fortunes of his time by speculating, even though he did go broke a few times in his career. Though this book describes how people traded in a bygone era, there is some timeless advice for investors (“I’ve always made my money from sitting, not thinking”) which will help your trading for years to come. Maybe you’ve heard of it on a real money online casino sites, maybe you’re intrigued, or maybe you’ve ever wondered how you can get involved.

One Up On Wall Street

Buffett has said that he writes the letters thinking of his sisters, who were smart and interested in business, but not as well-versed as he is in the matter. Readers will come away with a valuable education in business and investing. The investment world can be difficult to navigate, especially if you’re just starting out. There are lots of confusing terms and complicated acronyms that can turn off someone who’s looking to learn more about financial concepts. Our experts have been helping you master your money for over four decades.

Sokunbi discusses how the stock market works, the importance of compounding, types of investing, how inflation impacts your financial picture, and the range of financial subjects. While published almost 100 years ago, its vivid and engrossing portrayal of success and failure has lessons that remain relevant to the present day. A truly timeless tale, “Reminiscences of a Stock Operator” has remained the most recommended and read investment trading book ever. However, people who want to learn to trade on the stock market can have a tough time finding the right book to help them with the task. An investor having absolutely no idea of the term technical analysis should look to get their hands on this book. This book by the vastly recognized financial expert and one of the best-selling authors, Jack D. Schwager gives all the answers a rookie needs.

Real estate investing is another way to diversify your investment portfolio and make returns. The authors are co-hosts of the real estate podcast, „BiggerPockets Podcast.” ” is a classic financial satire by Fred Schwed Jr. that takes a hard look at Wall Street and the financial world. It’s a humorous take on the industry and is written in an approachable and entertaining style. The book is around 200 pages and has been praised by financial writers and investors alike for its insight and wit. Schwed Jr. dissects the industry, exposing the ridiculousness and hypocrisy of the financial markets, and offers a fresh and humorous perspective on how Wall Street works.

- “Mastering the Market Cycle” is a 340-page book by renowned investor and author Howard Marks.

- Just make sure you understand the basics before moving on to this slightly more advanced reading.

- If you’re seeking an even larger selection, be sure to check out our companion guide featuring over 25 additional books on investing.

- Friends, today we learned the 7 best books for investing related to the stock market.

- He shows the readers how simplicity and common sense invariably trump costly complexity, and how the low cost is virtually assured to outperform the vast majority of wall street professionals over the long term.

The book is a great addition to an investor’s bookshelf as this guide is full of advice about trading in the stock market. The author discusses the best practices, techniques by illustrating examples from his own experience in the trading world. Written in easy to understand language, the book simplifies a vastly complex and critical topic of technical analysis for investors with limited experience in the trading world.

#4. Common Stocks and Uncommon Profits and Other Writings

The book Japanese Candlestick has been written by Steve Nison, who was one of the first to receive the title Chartered Market Technician (CMT). Join our free newsletter to get unlimited access to all startup data including startup costs. You’ll realize these people are just like you – and that, deep down, you can do it too. These aren’t just case studies – they are real stories, from real founders who share their most intimate details with you – down to the exact amount of money they are making. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers.com Annual Review. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News.